We start by understanding each individual’s situation before any solution is suggested.

No two financial situations are the same. We offer adaptable repayment options that adjust as circumstances change

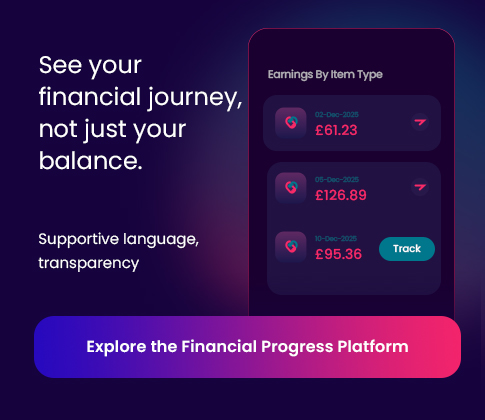

Clear communication sits at the heart of everything we do. Customers can view balances, payment history, and progress at any time

We replace traditional collection pressure with encouragement and support. Our focus is on steady progress, positive habits, and long-term financial wellbeing

Traditional debt collection models often rely on pressure, rigid payment structures, and outdated communication methods. Solvenza does the opposite.

Where customers can view their account, update details, and create payment plans that suit real-life circumstances — not automated expectations.

We empower customers to choose what they can afford, adjust payments when life changes, and progress at a pace that feels achievable.

We understand that debt can feel overwhelming or uncomfortable, and we remove the stigma by offering help that is calm, respectful, and human.

From budgeting support to household savings, we offer guidance that genuinely helps customers move forward — not just satisfy an obligation.

With on-time payment rewards, discounts, payment holidays and more, we encourage positive habits and celebrate progress.

Our business model is built on three core principles:

We give customers full control through our digital customer portal, where they can:

This removes pressure and replaces it with independence and clarity.

We understand that financial difficulties often come with stress, worry, or reluctance to

talk.

That’s why our model removes the need for uncomfortable conversations by offering:

Customers are encouraged, not confronted

We give customers full control through our digital customer portal, where they can:

Our model benefits customers, original creditors, and regulatory expectations by ensuring fair, humane, and sustainable outcomes